Occasionally, you might be desirous to faucet into your resources before you retire; nonetheless, for those who succumb to Those people temptations, you'll probably really need to pay back a hefty price.

Generating a Roth IRA withdrawal beyond the above requirements could lead to money taxes and also a 10% penalty.

Not legitimate with every other offer. Limit one marketing incentive for every GO2bank user and a person redemption for every registered account. Provide value of $five.00 could only be additional for your registered account and is probably not redeemed for cash. Offer you sponsored by Ingo Funds. GO2bank won't endorse or sponsor this give. Remember to enter GO2get5 to obtain your one-time $5 credit and tap “Use”.** The $5 promo code supply is valid just for users who correctly make use of the $five promo code from the GO2bank cellular app before the promo code expires on twelve/31/24. The $5 marketing incentive might be added to your authorised Look at amount and transaction depth is going to be managed with your GO2bank transaction background. All checks subject to overview for approval. Fees may well use. Go to for total details. Not legitimate with another supply. Restrict 1 promotional incentive for each GO2bank consumer and 1 redemption per registered account. Offer price of $5.00 may perhaps only be extra to your registered account and might not be redeemed for cash. Supply sponsored by Ingo Funds. GO2bank does not endorse or sponsor this offer you.

Enter your facts down below to check out exactly how much you might be giving up by withdrawing resources in advance of retirement.

Mortgage loan calculatorDown payment calculatorHow A great deal residence am i able to pay for calculatorClosing expenses calculatorCost of residing calculatorMortgage amortization calculatorRefinance calculator

The transfer procedure itself is seamless and tax-clever, because of the insurance provider’s direct transfer or rollover products and services, locking in fees and easing the transition.

Illustrations are hypothetical, and we persuade you to seek personalized suggestions from qualified industry experts with regards to unique financial investment troubles. Our estimates are dependant get more info on earlier industry general performance, and past effectiveness is not a guarantee of foreseeable future overall performance.

Arielle O’Shea potential customers the investing and taxes staff at NerdWallet. She has covered private finance and investing for more than 15 a long time, and was a senior writer and spokesperson at NerdWallet ahead of turning out to be an assigning editor. Beforehand, she was a researcher and reporter for top personalized finance journalist and creator Jean Chatzky, a role that included producing monetary education programs, interviewing material specialists and assisting to deliver tv and radio segments.

With their enable, you can decipher the benefits and downsides of various annuity withdrawal strategies, making sure that the choices you make are beautifully aligned with the retirement targets.

As we sail into your sunset of our earning many years, approaches for maximizing annuity withdrawals turn into the compass that guides us. Systematic withdrawals allow for to get a disciplined approach, guaranteeing you tap into your annuity in a very managed, penalty-absolutely free manner soon after age fifty nine½.

Our associates can not spend us to guarantee favorable assessments in their solutions or expert services. Here's a summary of our companions.

Card suggestion guideTravel benefits and perksEarn cash backPay down debtMake an enormous purchaseGet your approval odds

In addition, rolling more than to an IRA often interprets to decreased charges, which could turbocharge your investment returns about the lengthy haul. Economical establishments could possibly even sweeten the cope with cash bonuses or absolutely free trades, earning the changeover as rewarding as it's liberating.

Another excuse this era is so harmful is the fact that in case you continue on exactly the same degree of paying you started off with early in retirement by way of a downturn or recession, you run into a thing called the sequence of returns danger. This is where a adverse return early in retirement could devastate your portfolio as you proceed to invest, locking in losses, leaving a lot less still left to mature back again through the downturn and working with superior-fee instruments like mutual resources and variable annuities. Every one of these problems compound to depart you working out of cash before you decide to operate out of everyday living.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Barry Watson Then & Now!

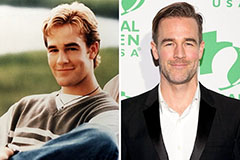

Barry Watson Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!